- CALL US::

- +447441444005

- +12028602860

- +12264577700

- +61250221222

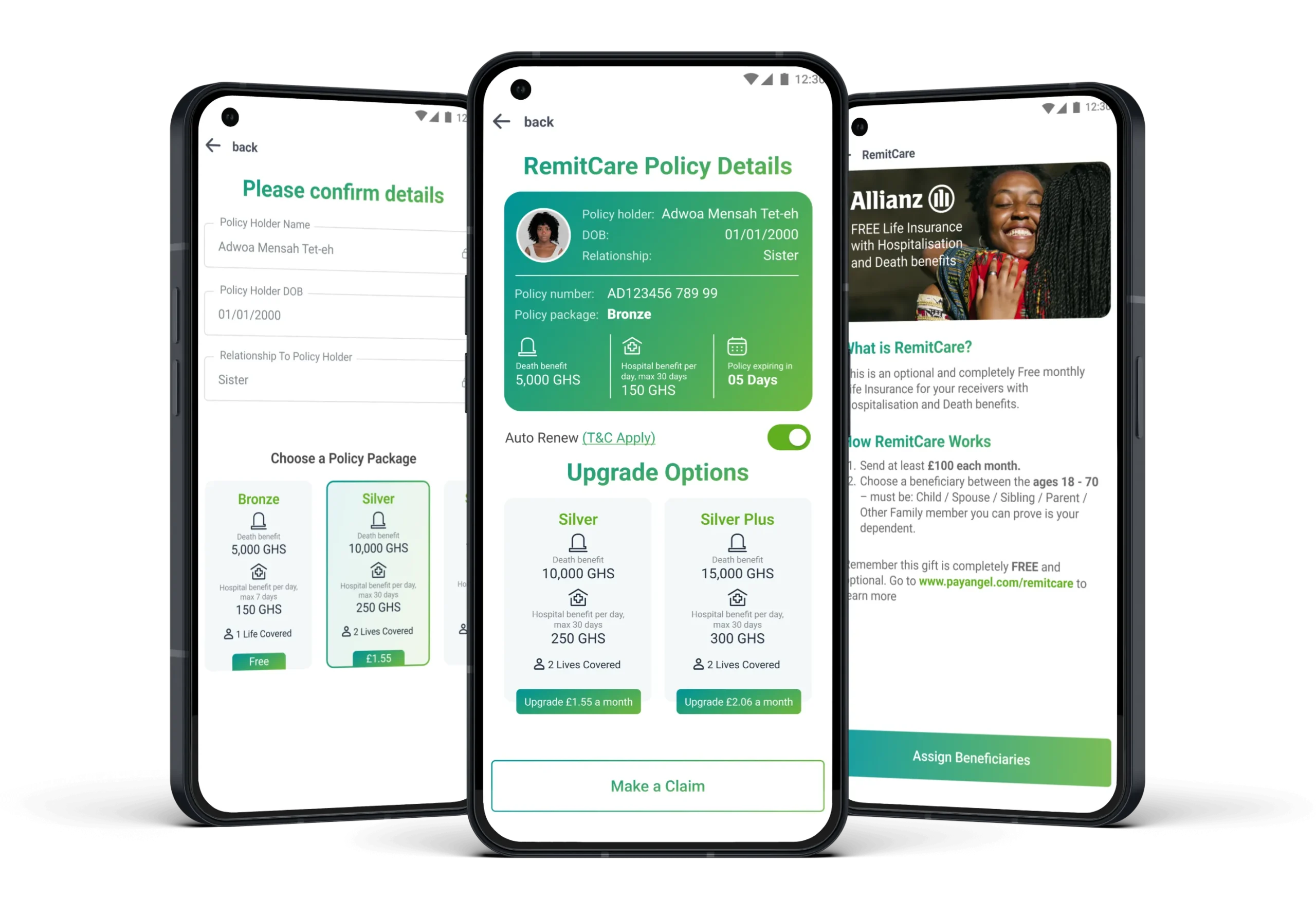

RemitCare is an embedded life insurance benefit linked to PayAngel remittances for Ghanaians receiving money. It is designed to provide peace of mind and financial support in the event of hospitalisation and, in the unfortunate event of death, support for the named policy holder’s next of kin.

RemitCare is provided at no additional cost by PayAngel in partnership with Sanlam Allianz. Coverage is subject to eligibility and the insurer’s policy terms & conditions.

Diaspora and migrants sending money to Ghana

Families and dependents receiving ongoing support

Anyone who wants added peace of mind beyond the transfer itself

Make your normal transfer to Ghana using the PayAngel app. Nothing extra to buy and nothing new to set up.

When you send GBP 100 (or USD, CAD, EUR) or more in a month, you become eligible for the Free Bronze RemitCare cover.

In the app, select one eligible family member or dependent in Ghana and confirm their details.

Once your transfer is completed and your beneficiary is set, RemitCare becomes active and stays active as long as you keep sending qualifying transfers.

Only successful and completed transfers activate or renew coverage.

Choose the level of protection that fits your family.

Start free with Bronze or upgrade anytime for higher coverage.

RemitCare is a value added protection benefit linked to your PayAngel transfers. It is not a standalone insurance policy and is only active when the eligibility conditions are met.

Any registered PayAngel user who completes qualifying transfers and assigns a valid beneficiary in Ghana can be eligible.

The Free Bronze Plan is the default RemitCare cover. It provides basic hospital and death support for one named family member at no cost when you qualify.

No. The Free Bronze Plan has no sign up fee and no monthly premium.

A qualifying transfer is a successful PayAngel international transfer that meets the minimum monthly requirement. Cancelled, refunded, or failed transfers do not count.

You must send at least £100 or $100 in a month in successful transfers to activate or renew RemitCare

Your cover starts once you complete a qualifying transfer and assign a beneficiary in the app.

Coverage lasts for one month and can be renewed automatically when you continue to make qualifying transfers.

You can cover one eligible family member or dependent. This can include a child, spouse, sibling, parent, or other dependent, provided they meet age and verification requirements.

The Free Bronze Plan covers one life at a time. Higher plans in the app may allow more than one person to be covered.

RemitCare provides a death benefit and a daily hospitalisation benefit, within the limits of your active plan.

Fraudulent claims, false documents, illegal activity, or events outside the active coverage period are not covered.

You can see your coverage status inside the PayAngel app in the RemitCare section and may receive an in app notification after activation.

Log in to PayAngel, go to RemitCare, select your active cover, and submit a claim with the required documents.

You may be asked to provide proof of transaction, valid identification, and medical or official documents depending on the claim type.

Check that your transfer was successful and meets the minimum amount. If it still does not appear, contact PayAngel support.

Use Help and Support in the PayAngel app or contact PayAngel support by email or phone.